Ship financing requires protection for lenders as well as a legal mechanism for ship owners to borrow against the security of the ship. The Preferred Ship Mortgage was designed to provide that protection for lenders in the form of a recognized lien against a documented vessel and a mechanism for ship owners to access financing.

A Preferred Ship Mortgage is filed with the United States Coast Guard, in order to ensure that such a document is transparent, enforceable and has priority over nearly all other claims on the vessel. It is commonly used by lenders and vessel owners.

The article covers the basics of Preferred Ship Mortgages, the legal aspects and how they compare with other ship financing methods, and how to secure and manage them.

What Is a Preferred Ship Mortgage and Why It Matters

It designates the lender as a preferred creditor (superior to all other creditors, except for a small number), and thus gives the lien one of the most powerful forms of maritime security.

Key Purposes of Preferred Ship Mortgages

- Lender Protection: Guarantees lenders can repossess their vessels.

- Owner Financing: Borrowers must purchase vessels with loans from a lender.

- Public Record: Filed with the United States Coast Guard.

- Priority of legal claim: Higher than most liens in the event of default.

| Feature | Description | Benefit for Parties |

|---|---|---|

| Legal Filing | Recorded with U.S. Coast Guard | Provides enforceability and notice |

| Lender Protection | Grants priority over most other claims | Secures lender’s financial interest |

| Borrower’s Rights | Allows use of vessel during loan repayment | Ensures business continuity |

| Default Remedy | Lender can seize vessel if debt unpaid | Lender can seize vessel if debt unpaid |

It provides lenders with some certainty and gives vessel owners a secure means of borrowing.

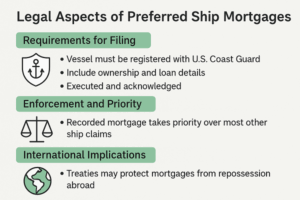

Legal and Regulatory Aspects of Preferred Ship Mortgages

Preferred Ship Mortgages are covered within the Ship Mortgage Act, a federal maritime law.

Requirements for Filing

The vessel must be registered under the U.S. Coast Guard. The mortgage must describe the ownership. It also needs to describe the loan details and repayment.

Enforcement and Priority

If the Ship Mortgage is recorded, it has priority over nearly all other ship claims except for certain maritime liens, such as for crew wages or salvage.

International Implications

Outside US waters, treaties such as the Geneva Convention and bilateral treaties may protect mortgages from effects such as repossession from outside US waters.

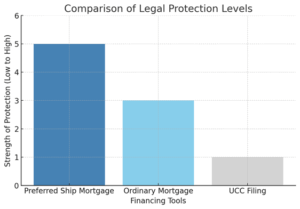

Comparing Preferred Ship Mortgages with Other Maritime Financing Tools

Ship Mortgages in maritime finance also have advantages over other types of ship loan security.

Preferred Ship Mortgage vs. Ordinary Mortgage

- Preferred Ship Mortgage: Provides federal recognition and priority lien status.

- Ordinary Mortgage: May lack enforceability against third parties.

Preferred Ship Mortgage vs. UCC Financing

- Preferred Ship Mortgage: Specific to vessels, filed with U.S. Coast Guard.

- UCC Financing: General security interest filed under state law, weaker in maritime disputes.

- Mortgage gives the strongest protection.

- Ordinary Mortgage offers medium protection.

- UCC Filing provides low protection.

This is precisely why lenders typically prefer Preferred Ship Mortgages.

Practical Guide: How to Secure a Preferred Ship Mortgage

To make a Preferred Ship Mortgage enforceable, a number of steps must occur.

Step 1: Confirm Vessel Documentation

The vessel must be federally documented prior to filing.

Step 2: Draft the Mortgage Agreement

Details of the parties involved, the terms of the loan, the vessel, and the repayment conditions.

Step 3: Execute and File with U.S. Coast Guard

The mortgage must be signed, acknowledged, and recorded by law.

Step 4: Maintain Loan Obligations

Borrowers must stay current on payments. They must document the vessel.

Why Preferred Ship Mortgages Are Essential

At National Documentation E‑Portal, the Preferred Ship Mortgage is the basic form of it, giving lenders the greatest possible security for their investment while giving the owner the greatest access to capital. It creates a federal lien which will take precedence over most other claims.

Unlike other types of financing, it provides transparency and enforceability on the transactions, and therefore it gives comfort to owners and lenders. A clear comprehension of the process is also very important to owners and lenders in order to protect their interests and have future opportunities in maritime business.