A Release of Mortgage Form indicates that a mortgage has been fully satisfied and removed from the public records. When the payment of a loan secured against a vessel or asset is fully made, the document is a formal confirmation that the lender has no financial interest. Without this, the records may show an active lien when no debt actually remains. Transfers, sales, or renewals will make you wait.

Most owners think that paying off a loan means that the mortgage is gone. Actually, the release must be duly filed and recorded. Public authorities rely on this documentation to prove ownership clear. The mortgage stays visible in official registries until the processing.

The article explains release process in detail with the help of examples. It provides information on the form’s functioning, the person liable to file it. What happens after the approval. Owners can steer clear of unnecessary entanglements and safeguard their good ownership through the understanding of these steps.

Understanding the Mortgage Release Form and Its Importance

The letter formally declares that the lender’s financial interest in the mortgage property has ended. It serves as a legal affirmation that the borrower has settled all dues. Recording it removes the mortgage from the registry, restoring clear title ownership.

This document protects the rights of both the owner and the future purchaser. It avoids disagreements on outstanding debt for owners. It assures the buyer that the asset is lien-free. The authorities and registries depend on this document for ownership records.

Not having a release can cause problems. If the release is not recorded, it can block it from transferring and refinancing, even though the loan is paid. Inspections or due diligence reviews typically identify an outstanding mortgage as a compliance issue.

| Ownership Status | Before Release Filed | After Release Filed |

|---|---|---|

| Mortgage record | Active lien shown | Cleared from records |

| Ownership clarity | Restricted | Fully clear |

| Transfer ability | Limited | Unrestricted |

| Compliance status | Conditional | Fully compliant |

Thus, filing the release ensure the records reflect the financial reality. It is a vital final process in closing any mortgage law.

Rules of Court, Supporting Documents & Evidence

The release process follows specified legal steps. It is normally the lender’s responsibility to monitor completion but owners should keep an eye on it as well. When we don’t follow up, we tend to delay.

Who fills out and signs the form

The lender/mortgage holder is responsible for preparing the release. An authorized representative must sign it. This signature reflects that the debt has been fully paid.

Owners must ensure the information is consistent with original mortgage documents. Acceptance may be delays honest errors in name, date or reference number.

Update of submission and record

After completion, the form is sent to the assigned authority. The registry checks it for completeness and validity. Once acknowledged, the mortgage is removed from records.

Processing times can depend on workloads and accuracy. Re-submissions are often incomplete. Copies should be retained by owners for future reference.

Include often required key documents

- Mortgage reference details.

- Confirmation of loan repayment.

- Approved Lender Signature.

- Proper identification of vessel or asset.

Authorities can validate authenticity and update records more efficiently.

Outcomes Comparison: Recorded Release vs No Recorded Release

The filing of release shows its effect of comparison of outcome. Often the owners face issues only while attempting a transfer or Renew Certificate.

A lien remains active even if nothing was officially released. Transaction may be suspended or asked for more verification.

Ownership records show no encumbrances after filing. Transactions go ahead without problems. Checking compliance was not so tiresome.

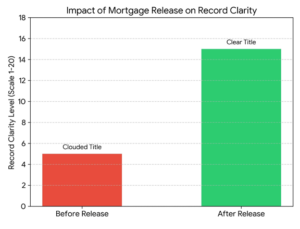

- The dramatic clarity increase by recording a mortgage release is from Clouded Title (Level 5) to Clear Title (Level 15). It’s a 300% clarity boost.

-

An active lien record proves that a debt exists, even if the borrower has already paid it. The After Release status shows anyone who searches your property or makes an inquiry that you have legally discharged the financial obligation.

-

Guidance for Owners and Lenders

Owners must not take it for granted that the process is automatic. Regular monitoring will ensure completion. First, establish whether the lender must file a release.

Please request a signed copy of the form. This documentation will provide guarantee and proof if delay occurs. Please scrutinize the layout. Check names, identifiers and dates match what is in the record. Please submit or confirm submission. Keep checking the registry updates until the discharge does update. Save the final confirmation for yourself.

Best practices that are helpful for Release of Mortgage Form

- Follow up with lenders after last payment.

- Maintain both digital and hard copies of the release.

- Check that registry updates stay timely.

- Fix mistakes right after finding.

These steps help limit risk and ensure a clear title.

Takeaways and Final Summary

A Release of Mortgage Form is official confirmation that this mortgage obligation is over. The clearing of any liens from official records restores full ownership rights.

Owners can benefit from understanding and monitoring this process. National Documentation E‑Portal File your transfers, renewals, or sales on time. Detailed records help ensure compliance and preserve asset value.

Owners can ensure records remain accurate by using appropriate measures and clearly communicating with lenders. This final step completes the mortgage process and gives lasting peace of mind.