A Notice of Claim of Lien is a very powerful instrument to protect your financial interest related to a vessel. The document officially records a creditor’s assertion against a vessel due to a payment default. This notice is public proof of the existence of a debt and that the vessel continues to be encumbered. Creditors can lose priority or enforceability if not filed.

Vessel owners must also understand the notice. Having an active lien may restrict a sale, transfer or refinancing. Most owners find out about a lien when they try to complete a transaction and this causes delays. Knowing how liens work clears any surprise.

This article explains the Notice of Claim of Lien in detail. It goes through what it is for, legal basis, filing requirements and practical effects. Through documentation and understanding of the process, creditors and owners can protect their interests in vessels.

Get to Know Notice of claim of Lien

A Notice of Claim of Lien states that a party claims to have a financial claim against a vessel. It is usually utilized when services, repairs, supplies, or financing go unpaid. After it is filed, this lien will form part of the ship’s record.

The vessel is not automatically seized by the notice. It creates priority and visibility instead. This record that is accessible to the public warns buyers, lenders and others about the debt.

The Notice of Claim of Lien is critical to maritime transactions. It safeguards creditors by maintaining their entitlements. It helps to ensure transparency of vessel records.

From a legal perspective, timing matters. Swift filing of notice ensures enforceability. Filing documents late could weaken standing against other claims.

| Status Aspect | Before Filing | After Filing |

|---|---|---|

| Public Record | No Visibility – Ownership and liens are private knowledge; buyers lack protection. | Officially Recorded – The vessel’s status is searchable via an Abstract of Title. |

| Creditor Priority | Unclear – Claims are ranked by time or type; unrecorded mortgages may be ignored. | Established – Achieves “Preferred” status, outranking most subsequent maritime liens. |

| Vessel Transfer | Unrestricted – The owner can theoretically sell the vessel without the buyer knowing of debts. | Restricted – NVDC recordation prevents a clean title transfer until the lien is satisfied. |

| Legal Leverage | Limited – Lenders rely on personal contracts; seizure is difficult and legally messy. | Strengthened – Allows for in rem federal court actions and vessel “arrest” powers. |

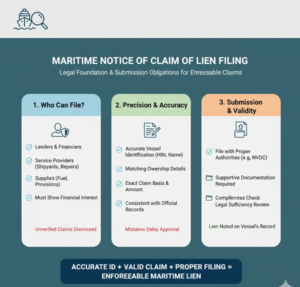

Legal Foundation and Submission Obligations

The Notice of Claim of Lien is governed by laws of admiralty and the documentation. The rules discussed here define who may file, when a filing is valid, and the ways in which claims are enforced.

Who is allowed to file a lien notice?

The groups that can claim under the code includes lenders, service providers and suppliers who have unpaid claims. The claimant has to show real financial interest. Claims that are unsupported or incorrect may be dismissed.

Precision is critical. The identity of the vessel Waiver Application, the ownership details, and the amounts claimed must match the official records. Mistakes frequently postpone approval.

Preparing papers and documents

The applicant will file the notice with supporting details with the department. Relevant authorities will review the submission for completeness and legal sufficiency. After acceptance, the lien goes on board the vessel’s record.

Main components for filing Lisbon system trademark

- The vessel identification is accurate

- Details of the claim

- The Basis and Amount of Your Claim

- Submission and execution may work.

Every element aids in legal validity and enforceability. Owners should respond to claims quickly to avoid problems.

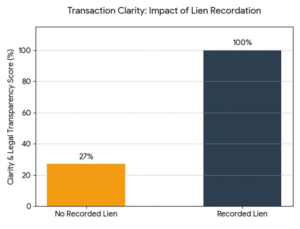

Outcomes with and without a recorded lien compared

The application is visible where other practical requirements are visible on deals and inspections. If no notice recorded, a creditor may find it hard to establish claim over property. Owners might unknowingly convey burdened ships.

The authority notifies the parties when it files a Notice of Claim of Lien. Activity on hold until resolution. It assists buyers and lenders in avoiding undisclosed liabilities.

- They’re In Sight: With a Recorded Lien, the total clarity score is 100%*, simply because the financial history of the vessel becomes public through an Abstract of Title. There’s no risk of buried debts that chase Unrecorded Liens (27%) soldiers.

- Once a lien is registered by the NVDC, the whole world is deemed to have notice by law. This stops later buyers or creditors from saying they were unaware of that earlier debt.

- Blocking Unauthorized Transfers: The recordation has a freezing effect on the title of the vessel at the federal level; and the National Vessel Documentation Center will not permit the transfer of ownership to be completed until the lender files a formal Satisfaction of Mortgage.

Open dealings lessen disagreements and lawsuits.

Real life example

A repairer does substantial work but not paid. Difficulty in Recovery. On the other hand, filing a lien stops the sale until payment.

This example proves the role of formal notice in protection.

Useful Tips for Owners and Creditors

Active management is beneficial to both the owners and creditors. Creditors should file notices in a timely manner. Procrastination undermines legal position.

The owners are to check vessel records regularly. Early notice of liens allows for quicker resolution. Neglecting claims raises disputes.

Creditors should check that the documentation is accurate before filing. Debate or reject incorrect filings. Precision Fortifies Enforceability

It is recommended to follow best practices

- Frequently check the vessel records.

- Respond to claims at the earliest.

- Check for correctness before filing the notice.

- Get official releases of lien post payment.

The subsequent steps will ensure a smooth process and compliance.

Important Points About Notice of Claim of Lien

A Notice of Claim of Lien is immensely helpful in the world of vessel documentation and maritime law. National Documentation E‑Portal promotes transparency to owners and buyers while protecting creditor rights. Proper filing ensures that claims are visible and enforceable.

Submitting Quickly and Correctly Allows Creditors to be First. Structured processes can benefit both parties. The lien process, if effectively managed, provides justification and protects the financial interests.